Although this is a Year In Review post for 2023, it will mostly pick up where my 2022 post left off. I finally got around to publishing that post in June and had already been through almost half of 2023 when I published it, so I won’t recap all of that time and will probably pick up from this post: My business is struggling. Here’s my plan to save it.

In many ways, this has been an amazing year. I find myself feeling particularly grateful for my family and friends, my community, my town, and my life in general. I have much to be thankful for.

But financially, this has been probably my most stressful year yet. When I was under contract for the house I bought in October 2022, I felt that my business was slumping a bit. At the time, I didn’t have enough information to know for sure if I was just having a down month, or if the business itself was in trouble.

Part of deciding whether to go through with the house purchase was gaming out the possibilities in front of me. At one end of the spectrum was something like, “I’m currently having a slow month, which happens occasionally, but everything is actually fine with the business and the new house will be no big deal.” At the other end of the spectrum was something like, “Worst-case scenario is my business is tanking and I’m about to 2-3x my monthly expenses at the absolute worst possible time.” As it turns out, I was pretty close to the worst-case scenario.

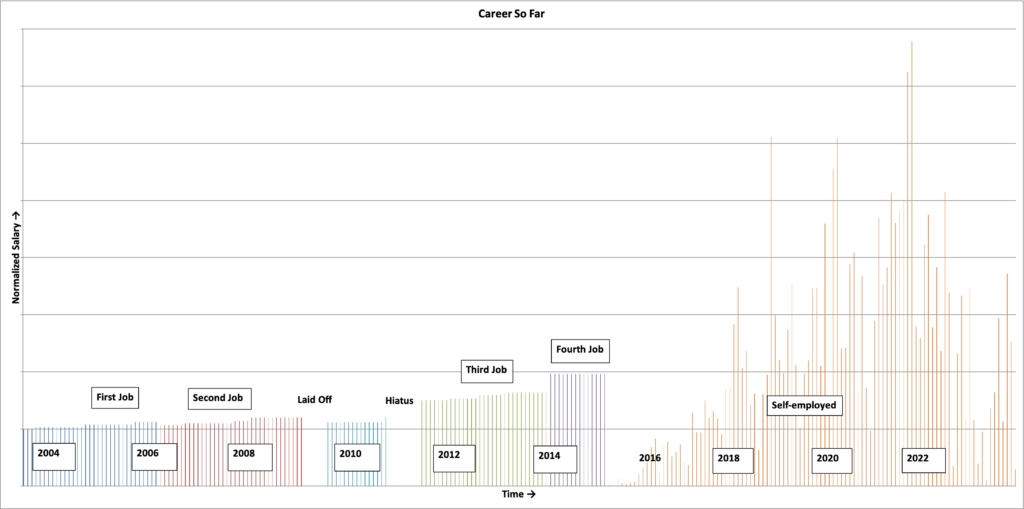

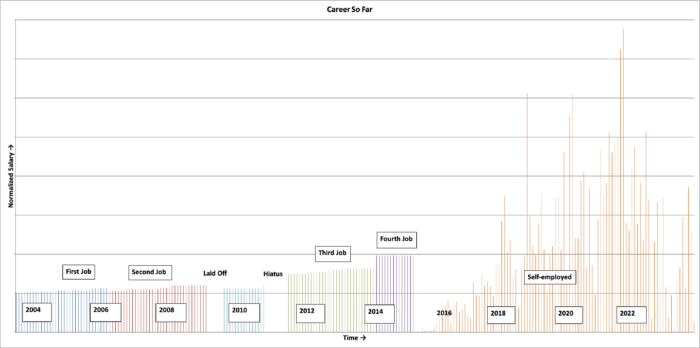

My business brought in about 50% less revenue this year than it did last year. Worse, it brought in less than 40% of what it made in 2021. That’s after growing every year since I started it in 2016.

That being said, the final few months of this year are looking up a bit. More than half of the business’s revenue has come in since September 1, which is when the downward slide started last year. It’s not “back”, but it seems to be trending in a good direction.

I’ll unpack a lot more of that later on, but for now that’s a high level overview of my year.

2023 Goal review

Things were so dire by the time I wrote my 2022 Year In Review that I only set one goal…

Survive to 2024

And I did!

Barely, but I’m still here, running my business and paying the bills. And so far I’ve managed to do this without taking on any debt (other than some cash that I’ve borrowed just in case, and which is parked in an interest-bearing account).

Obviously, just surviving is not fun, and I’m relieved that things seem to be turning around, but I continue to live in survival mode.

I think I’ll just leave this as-is for now since I’ll be unpacking a lot of the specific tactics that helped me meet this goal later on.

2023 Year in Review – Business

Where to begin?

As I mentioned above, revenue was way down this year, under 40% of where it was in 2021. It might be helpful to remember that 2022 was down about 32% from 2021 (after actually running ahead of pace for the first half of 2022). That matters because it shows just how bad the second half of 2022 was, and then how bad 2023 was.

This is all the result of an extremely lean period from around October 2022 through August 2023.

Here’s my updated “Career Earnings to Date” chart, which I’ve been maintaining for over a decade now. I won’t digress about how mind-blowing that is, but it’s pretty mind-blowing. Anyway, here’s the chart:

Stats

Here are the stats that I typically track:

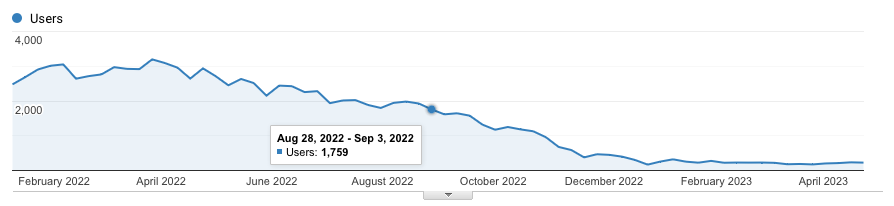

- Visits to FearlessSalaryNegotiation.com: This was down, but I’m unsure how much because Google Analytics overhauled their product and I can’t figure out how to get stats. It was 720,000 in 2022 and I’m guessing it was around 700,000 in 2023

- Unique page views: Same issue as above, but I’m guessing this was also down and under 1M

- Total email subscribers at the end of the year: About 26,000 (down about 5% year over year)

- Product sales through the site: About 40 (down from about 100)

- Coaching applications: 26 (down from 99)

- Coaching clients: 11 (down from about 22)

- Coaching conversion rate (from application to client) was 42% (up from 22%)*

*This number is probably too high. I got some clients who came through entry points that previously didn’t exist, and therefore who did not complete applications. I also had leads from those new entry points that did not convert. My best guess is I closed about 33% of people I talked to about coaching this year.

Coaching revenue was down about 50% year over year.

I think the best way to think about the business this year is from two perspectives: macro and micro.

The Macro view

The boring view is the macro view. If you zoom out far enough, the business is more or less the same is it has been for the past several years (since 2017 or so when I started focusing on coaching full-time). Most of my revenue came from coaching, which is my primary focus, and I also sell my book and courses on the product side.

I’m still a salary negotiation coach, just like I have been for the past six years or more.

The Micro view

While my business is pretty much the same thing from the outside looking in, I’ve made lots of changes under the hood. “Overhaul” might be too strong a word, but only just.

Focusing on high earners

The overarching change I made this year was to broaden my positioning as a salary negotiation coach to a much more general demographic: high earners.

I previously focused on software engineers and engineering managers going to big tech companies. That was a great market in 2021 and a horrible market in late 2022.

I had actually started planning this exact change in positioning—from “engineers going to big tech companies” to “high earners”—way back in 2020. As I began thinking through that change, the first part of my plan was to redesign and rebrand my website. As I worked on those projects, I was careful to create new branding that would appeal to the big tech market and be durable enough to appeal to high earners later on.

Many of the branding and logo ideas I considered had visual cues that would appeal to software engineers and people in tech, and I ended up going with something which was less tech focused and more broadly looked like a “luxury” brand.

I’m really, really glad I did this because it made the pivot to high earners trivial in terms of branding rather than requiring an overhaul.

Anyway, the big tech hiring slowdown that began in late 2022 served as a forcing function that caused me to revisit my original plan and move on it as fast as possible.

I rolled out the new positioning in the middle of the year (June) and then began the uphill climb of figuring out how to find high earners who needed my help.

If you want to read a lot more detail about my positioning change to high earners, this post is a deep dive into that project:

My business is struggling. Here’s my plan to save it.

Starting from scratch with marketing

The biggest challenge with my repositioning to high earners is how to find those folks and make them aware that I exist and that I can help them negotiate their job offers.

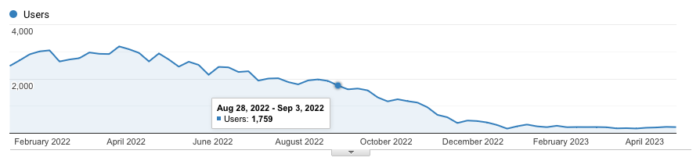

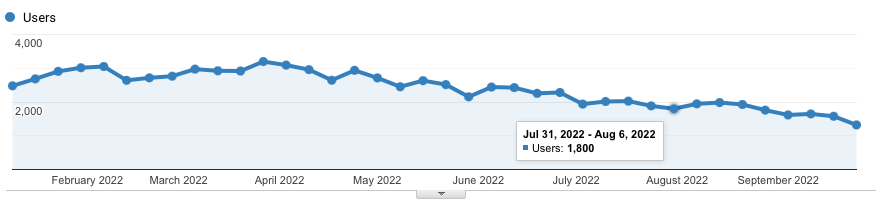

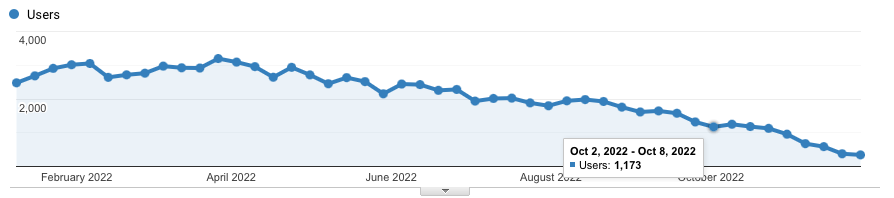

Until this change, my entire coaching funnel was SEO-based. Back in 2017, I got very good at SEO and I built a site that would rank high for specific things that software engineers and engineering managers going to big tech companies might be searching for when they had a job offer in hand.

This was effective for two reasons:

- There wasn’t much competition (yet) for these search terms.

- Software Engineers and Engineering Managers basically make a living by googling solutions to technical problems and finding the best solution. I got really good at making my site the solution to their “What do I do once I have a job offer from a big tech company?” problem.

But I couldn’t rely on this strategy for high earners for a couple reasons:

- Over the past few years, there has been a lot more competition for search traffic in my space. For a while there, I was basically the only person or company doing what I do. I still am, but there are a lot of other people and companies doing something similar, and they also jumped on the SEO strategy. Some of them even copied my work, published it to their own site with minor changes, and ramped up their own marketing efforts to outrank me. There were a few times when I would see a new site outranking me (I had been, say, #2 and was now #3) only to discover that they had repurposed my own content on their site and leapfrogged me. Not good.

- More broadly, high earners and software engineers look for solutions to difficult problems in different ways. I don’t think they’re googling “How do I negotiate [company] job offer?” Instead, they’re asking friends and family, looking for trusted sources, possibly listening to podcasts, or asking other professionals with adjacent expertise (law, accounting, executive coaching) for help, and searching places like YouTube rather than Google. They’re “search” is more like asking a colleague or mentor, “Hey, I think I’m about to get an offer that should be pretty good. Do you know anyone I can talk to that will help me avoid screwing this up and leaving money on the table?”

So I needed a new marketing strategy to replace my “inbound SEO” machine that had helped me grow the business for the past five years.

Before I even started working on a new plan, I realized that pretty much anything I did would be a long-term play. There was not going to be a magic bullet that would cause high earners to magically appear and ask me for help. This was simultaneously encouraging and discouraging.

Encouraging because I felt that once I figured out my new plan, it would be more robust and would work well for longer.

Discouraging because my runway was shrinking during the drought.

But I knew that if I was going to save the business and hopefully put it back on a growth trajectory, these were the changes I had to make.

I have never really used LinkedIn. For some reason (I honestly don’t remember why), I included a link to my LinkedIn bio in my book, which meant I slowly grew a network of about 1,000 contacts as people would send me connection requests.

When working with software engineers, I just didn’t focus on LinkedIn as a way to connect because that group is constantly inundated with recruiter spam, and I think they tend to ignore the platform. But with a focus on high earners, who I think use LinkedIn more traditionally than software engineers, it seemed like LinkedIn might be a useful way to find high earners and connect with them. This would be my first attempt at outbound marketing.

So far, I’ve added a couple thousand more connections so I have around 3,000. I think this is worth pursuing, but I still don’t know for sure.

Email strategy change

I’ve never been great at email marketing. For a while, I was pretty good at acquiring newsletter subscribers via SEO (I had about 60,000 subscribers at the high point), but my email list has shrunk as I’ve removed cold subscribers and lost my SEO mojo over the years. My list is around 26,000 right now.

Although I was pretty good at getting new subscribers, I was never great at selling my book, courses, and coaching to folks via email. I think I was better at this than I realized at the time, but still not good at it.

Over time, I had built more and more urgency into my email sequences and automated campaigns. My assumption was that folks who found my site were likely in pretty urgent need of help, so I didn’t have time to “nurture” them with weeks or months worth of emails before telling them about things that I sell.

When I launched Salary Negotiation Mastery, I ramped this up even further so that my email strategy was to offer a three-day discount on the program as soon as they joined my mailing list.

Not only did that not result in sales, but it resulted in very high attrition (via unsubscribe rates) while I tried it.

I think this was on experiment worth running, but the result was “this doesn’t work.”

The truth is that I really don’t like that sort of urgency-based hard-sell strategy anyway. It’s not me, and it’s not how I approach sales for my coaching service.

A few months ago, I started implementing a totally different strategy: slow, permission-based marketing buttressed by high-value newsletters. Basically a 180 from what I was doing before. No more urgent sales. No more “send all the Black Friday emails to everyone on the list and let them unsubscribe if they don’t want to see them”.

Now everything is based on my weekly newsletter, and subscribers will essentially raise their hand to hear more about a promotion or product that might be helpful to them. Everyone who joins my newsletter gets a five-email series that essentially lays out my worldview vis-a-vis career management and salary negotiation. My goal is to teach something profound and to set expectations for what it’s like getting emails from me. Then, if they choose to stick around, they’ll get my weekly newsletter.

For the weekly newsletter emails, I’m working hard to make them as valuable as possible so that every one of them offers some kind of “Whoa!” moment for the reader. Occasionally, I’ll include a PS or a note that says something like “By the way, based on what you’ve told me, I think this product or service I offer might be good for you. Want to hear more? Click here and I’ll send you some info.”

This is a totally different approach than what I’ve done for the past few years. I’m early in this transition and I think 2024 will be when I’m finally all-in on it, but I’m happy with how things are going so far. It feels more natural to me and I think it aligns better with a luxury-based business approach. Luxury brands don’t generally use high pressure sales tactics—instead, they just continue existing and making excellent things while their future customers move toward them.

Referral program

I also created and rolled out a new referral program so that I’m more top of mind when someone—a former client, newsletter subscriber, friend, someone who hears me on a podcast or finds my work online—knows of someone else who might need my help.

I have always gotten clients through referrals, but with my focus on high earners and as I move the brand to something more akin to a luxury brand, I think a referral program makes a lot of sense. High earners talk to each other about what’s working, and a referral program is a way to encourage those discussions.

One challenge was figuring out how to structure the referral program and to find the right amount for a referral bonus. I decided to offer a referral bonus to folks to send other folks my way, and I chose $1,000 per referral because I think pretty much anyone will perk up when they hear, “Send someone to Josh, get $1,000.”

I literally tested this by telling people about the program and the referral bonus amount in person while I was figuring out what to do. I noticed a distinct eyebrow raise when people heard the number 1,000.

I have already noticed more people telling other people about me, and I’ve been able to give a few referral bonuses, so I’m optimistic this is going to be a longterm benefit to me and my clients.

Coaching price increase

A big change I made mid-way through the year is that I raised my prices for the first time in about 4.5 years.

Last time I tried raising my prices, I had a 10-week drought during the busiest time of the year—literally no one hired me at the higher price.

But my business and clients have evolved substantially since then, and it felt like it was time to try again.

I have continued to work with folks who earn more and more, and who are more senior in their organizations. That means the value I add—in nominal terms—is quite a bit higher (per client, on average) than it was in 2019.

I have also been moving the brand in a “luxury brand” direction, and in the luxury world, high prices themselves communicate a lot about the service being offered.

So the impetus for starting the referral program—the fact that I was moving toward working with high earners—was also a good impetus for raising prices.

I also needed a way to make the referral program work for the business: If I offered a $1,000 referral bonus, that would come out of a $3,000 service fee. That’s a big portion of my margin on the service fee and I just didn’t think the business could afford to absorb that sort of reduction in per-client revenue.

So I raised my service fee to $5,000 while leaving the result fee the same.

This time, people hired me without hesitation and those people told other people about me. In 2019, my business wasn’t ready for a higher service fee, but in 2023 it was.

Here’s the crazy thing: There are several people who have followed my business from day one, many of them from afar, and they had occasionally encouraged me to raise my prices. When I finally did, one of them said, “$5,000? That’s it? I thought you were already charging $10,000!” He wasn’t kidding. I’m not there yet, but I think it’s plausible that a $10,000 service fee will be right some time in the future.

2023 Year in Review – Personal

This year’s Personal update will probably be a lot shorter than the Business update. While my business doesn’t define me, it is how I make my living, and that has been pretty seriously constrained for the past 15 months or so after several years of growth.

When the business was growing, it was easier to just treat it as a separate thing that sent me regular paychecks. When the business stalled and the regular paychecks slowed down or stopped entirely, it had a pretty big impact on my personal life.

All that to say that I’ve spent a lot of the past year trying to get the business on the right path, while trying to survive financially, which means “Business” and “Personal” have been regretfully intertwined. And that means much of my personal update already happened above.

Still, I did some stuff this year!

Ski trip in Breck

Ski trip was a mixed bag this year thanks to an unlucky set of factors. First, I scheduled a private ski lesson for my first day on the mountain. Unfortunately, I also got mountain sickness during the lesson, which was … not ideal. I finished the lesson, but wasn’t able to get as much out of it as I was hoping (because I was just trying to stay out there and survive rather than really engaging with my instructor’s feedback).

The second day, when I was going to try to start working on the stuff I learned in my lesson, our group went immediately to black bowls at Vail and my ski binding got messed up, so I had zero productive runs. That left me with about two days at Breck, and I did make some progress, but nothing like I have in past years.

On our last day out, I was sitting on the lift next to a snowboarder friend. When we went to get off the lift, his snowboard pinned my left ski underneath it. No biggie – that happens sometimes. Unfortunately, my left ski’s tip also pinned my right ski’s tip. If you picture an inverted “V”, that’s what my skis looked like as the lift pushed us forward with his weight on my left ski, and my left ski pinning my right ski. As the lift pushed us forward, the backs of my skis slowly slid apart while the tips were still pinned, so I literally could not move them. Eventually, the backs got so wide that I fell on my back while both of my feet were still locked into my pinned skis on the ground. The result? Two pretty severely sprained MCLs (and I think I was very lucky that I did not tear one or both of them). It took me about two months to recover completely. So I lost about half of my last day as I (wisely) decided to just head back to the house and not push my luck on sprained MCLs.

A freak accident and another unlucky wasted day.

I left this year feeling kind of deflated and frustrated. I made progress, but nothing like what I was hoping for when I booked that private lesson.

Community (and indirectly, The House™)

I’ve been in my new house for almost 15 months (after over 15 years in my previous house), and I big reason I decided to make the move was that my new house would allow me to host a lot more cool stuff for my community.

I’ve been in Gainesville for over 17 years since I moved back (after being here for five and a half years during undergrad), so I have a pretty big community that’s a mix of people from my church and friends who are also townies.

This year, I hosted lots of events, big and small, and probably had a couple hundred people in my house. That is awesome and Josh of even a few years ago would not have believed you if you told him that Josh of 2023 would be saying that.

I am still not even tapping into all the potential I saw in the house when I moved in, and I’m hoping that my business turns around this year so I can keep making improvements and hosting even more cool stuff.

Pickleball

When I first started taking pickleball seriously (mid-2021), my goal was to get to a 4.0 level by the end of 2022. I was making good progress, but then around August of 2022, I tweaked my back at the gym and developed tennis and golf elbow. That set me back quite a bit.

But my back issue resolved earlier this year and the tennis elbow is now more of a nuisance than a hindrance, so I made a lot of progress this year.

I asked my unofficial pickleball coach where I’m at now, and he puts me at “4.0 with a ton of variance”. My serve is my best shot (which he puts at 5.0), and my worst shots are on unpredictable balls and playing from the mid-court (3.5).

What’s weird is that I don’t really work on my serve; other than in-game, I never even think about it. But it’s actually slowly getting better as I try slight variations and just get better at power and topspin. It’s pretty nasty and low-variance.

On the other hand, pretty much every other aspect of my game is high-variance but less high-variance than a year ago.

My next goal is to get to a 4.5 level. I don’t know if that’s possible, but I think it is. It’s possible I’ll make big jumps this year because I’ve finally learned most of the fundamental shots and the changes I’ve been making recently are very subtle changes that result in substantial improvements. For example, changing my paddle angle to be slightly more closed on dinks has made my dinks much better and more offensive while also resulting in fewer pop ups. Another example is that I’ve been laser-focused on not attacking from the transition zone and working on my resets. That’s happening pretty quickly and has made me much better. So I’m at the stage where making a small tweak can provide a big improvement.

I’m not putting a timeline on getting to 4.5, but I don’t think it’s crazy to think it might happen in 2024.

Odds and ends

Conspicuously absent this year: running. My last run was in late February before ski trip.

I had about 380 workouts this year. That is about 150 pickleball sessions (including drill sessions), 150-ish gym workouts, and 70 or so yoga workouts. That’s a pretty good year!

I’ll be crossing 200 yoga sessions in the next few weeks.

2024 Goals

This year, I have two goals (twice as many as last year!).

100% business growth

Last year, hoping for 100% growth would’ve been really ambitious, but now it’s more like, “It would be nice to get the business back on track so it’s getting close to the all-time high of 2021.

Now that I think of it, this is less of a “goal” than a “hope”—if I can do this, then a lot of the financial pressure I’ve felt for the past 15 months will have abated, and that would be really nice for a change.

The good news is that I think I’ve done most of the heavy-lifting to reconfigure the business and set it up for this kind of growth. This year, I’ll get to see if my instincts were right and if the big changes I have made were the right things to do. We shall see.

Make progress toward 4.5 in pickleball

I think I’m unlocking skills that could help me move sort of quickly toward this goal, but I don’t feel confident enough to actually set “get to 4.5” as my goal here. Good progress would be fine.

I’m very aware that, for a lot of players, hitting 4.5 is no big deal. But given where I started a few years ago—literally unable to hit the ball and no understanding of the game—my best measuring stick for progress is myself and my own limitation, and by that standard, my progress so far has been remarkable. Getting to 4.5 would be extremely surprising to anyone who saw me play before, say, mid-2021, so it would be cool to get that done eventually.