What a year.

Looking back on the past 12 months, most of what stands out is personal stuff and business stuff is secondary. That’s surprising because my business still grew by a substantial amount, but the day-to-day struggle and grind of bootstrapping something from nothing has given way to something more like tending a garden or spinning a flywheel.

The foundation and systems I worked so hard to build beginning in 2016 are working and the payoff for all the stress of quitting a stable day job to jump into the entrepreneurial deep end has arrived.

Things are good in the business. I’m not saying I’m complacent and I’m definitely not resting on my laurels, as you’ll see in the Goals section below, but I’m in an entirely new phase of business and life.

Personally, things are fantastic, but there’s an alternate universe where 2019 was a horrible year full of pain and loss. Having had at least one year like that already, I can appreciate how special it is to have avoided virtually all of that potential pain and loss this year, finishing up the year with so much to be thankful for.

So while the business continued to move up and to the right, I was able to enjoy life itself more by appreciating all the great things I experienced and all the terrible things I didn’t experience.

Here’s a Table of Contents so you can jump to wherever you want…

- 2019 Goal Review

- Double revenue again

- Product revenue

- Services (coaching) revenue

- Sub-7:00-pace 5k

- Sub-60-second 400m

- More trips

- 2019 Year in Review – Business

- Two milestones to close out the year

- Income from my business now exceeds my day job income

- I’ve recovered all the savings I burned building the business

- Products

- Salary Negotiation Coaching

- My old fee structure

- My new fee structure

- Mistakes were made (by design)

- This is what running a business looks like

- Stats

- 2019 Year in Review – Personal

- Injuries

- Adductor

- Shoulders

- Eye surgery

- Travel

- In Breck for the Breckpocalypse

- My first trip to New York with a quick stop in Jersey

- Running

- Best possible outcome

- 2020 Goals

- Increase revenue by 50% again

- Sub-7:00-pace 5k

- Sub-60-second 400m

- Travel more

- Be more generous

2019 Goal review

Double revenue again

This was definitely a stretch goal and I missed it … sort of. Net revenue grew by about 54% this year, and that’s less than 100%. But it’s much easier to see progress if I break my revenue into two categories since I’m really running two distinct businesses that both happen to be built around salary negotiation.

Product revenue

I sell products like my book, Fearless Salary Negotiation, and other more narrowly-focused products like The Salary Negotiation Crash Course to help people negotiate job offers, get raises, navigate the interview process and that sort of thing.

Revenue for this part of the business was up by about 10% this year.

While I was hoping to double revenue in product sales, I’m still pretty happy to see any growth here because I stopped offering strategy sessions, which generated meaningful revenue in 2018.

This decision was driven by three challenges:

- Strategy sessions were somewhat time consuming and were more or less random. I couldn’t plan for them and they could be pretty disruptive to other work, including coaching engagements.

- Strategy sessions might occasionally cannibalize my coaching business. I don’t think this happened very often, but occasionally someone might decide to forego my full-service coaching offering in order to just book a strategy session. If they would’ve benefited from my full-service coaching offering, then we both lost—they got less and so did I.

- The pricing for strategy sessions cheapened the perceived value of my time and expertise. Although the sessions themselves were not cheap, when compared to my coaching offering, they looked cheaper and that’s not the best way to position a premium offering.

Last year, strategy sessions were about 20% of my product revenue. So that means I eliminated the offering that made up about 20% of my 2018 product revenue and still grew that part of the business by about 10%. I would like to see more growth here, but I’m still fine with it given my primary focus on coaching.

Services (coaching) revenue

Then there’s coaching, which generated most of the revenue and growth in my business. Last year, coaching was about 45% of my revenue. In 2019, my coaching revenue is up about 140% and it makes up almost 70% of my revenue.

This was driven by a greater focus on coaching, eliminating strategy sessions, changing my pricing structure, and by simply continuing to exist as my brand and reach grow.

Overall, I’m very happy with this growth and I expect coaching to continue growing into 2020 and I think I’ll see more substantial growth in product sales next year as well.

Sub-7:00-pace 5k

Miss. I was rehabbing a strained adductor for the first half of the year and didn’t get to 100% until September or so. I’ll have to push this one out to 2020.

Sub-60-second 400m

Miss. Same issue, but even worse because I would have to train specifically for short distance and even now I’m not back to full sprints. I’ll have to push this to 2020, although I’m still not sure if I’ll ever be able to get this done.

More trips

Technically, I took fewer trips this year. But I went to New York for the first time, so I actually chalk this up as a win.

2019 Year in Review – Business

This year was an unequivocal success.

Revenue was up more than 50% overall, and it grew in each of my two main categories—products and services.

I don’t actively track my time, but I’m sure I spent less time working this year than I ever have, so the return on my time is way up this year as well. That’s a sort of hidden side effect of the business I have been building and it’s a huge motivator for me to keep doing what I do and it was a big reason I quit my day job four years ago.

I had two issues with my day jobs:

- I thought the way we did work in corporate settings was really inefficient and I could do most of my jobs well in about 20 hours a week. The problem was that day jobs expected me to be “working” 40 hours a week. And that meant I spent about half my time doing my job and half my time performing the role of “person doing a job”.

- I was tired of making other people money. I felt that if I really dialed in my focus, picked a direction, and tried to build a business, then I could capture more of the value of my work, leading to higher overall pay.

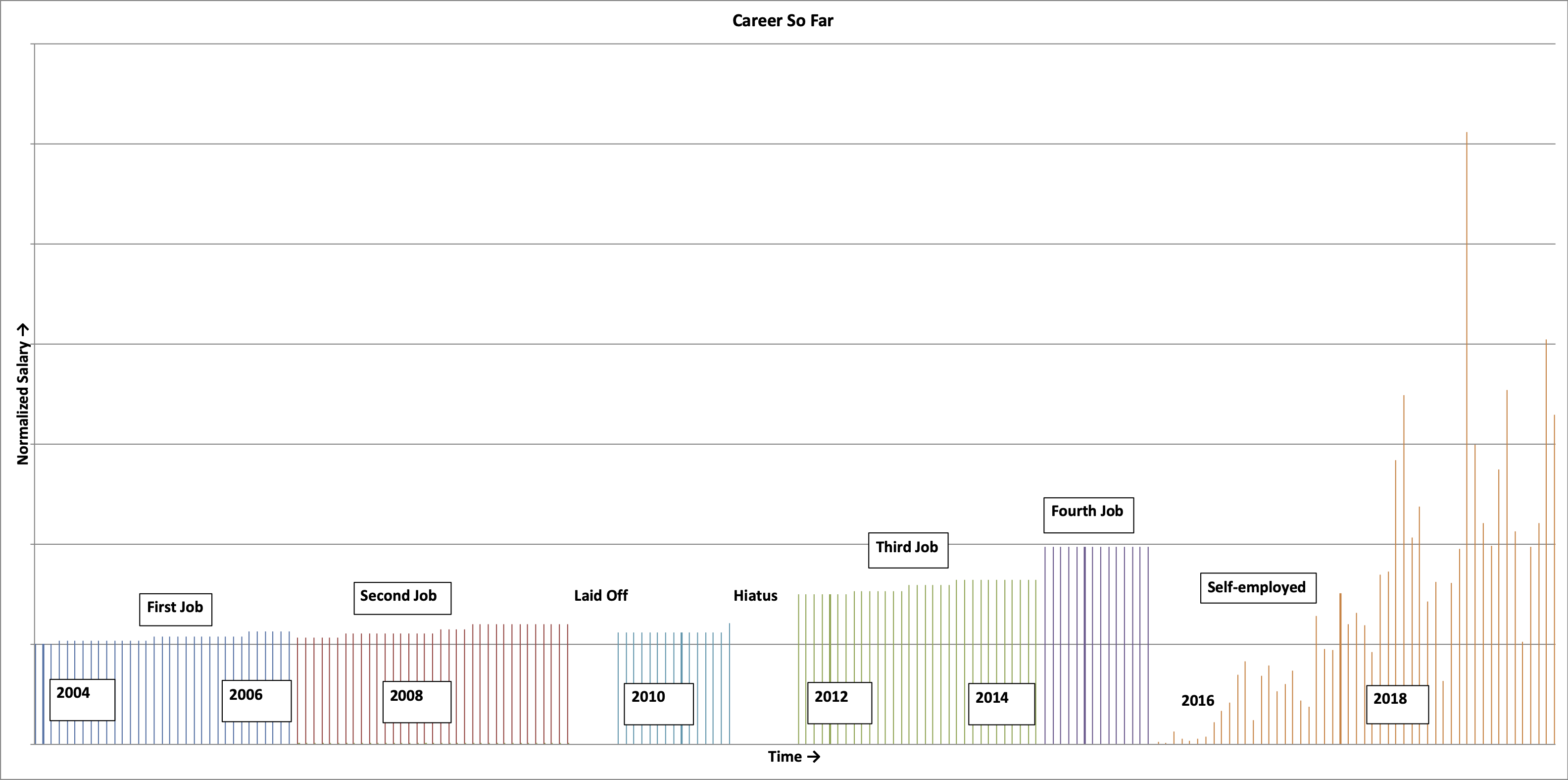

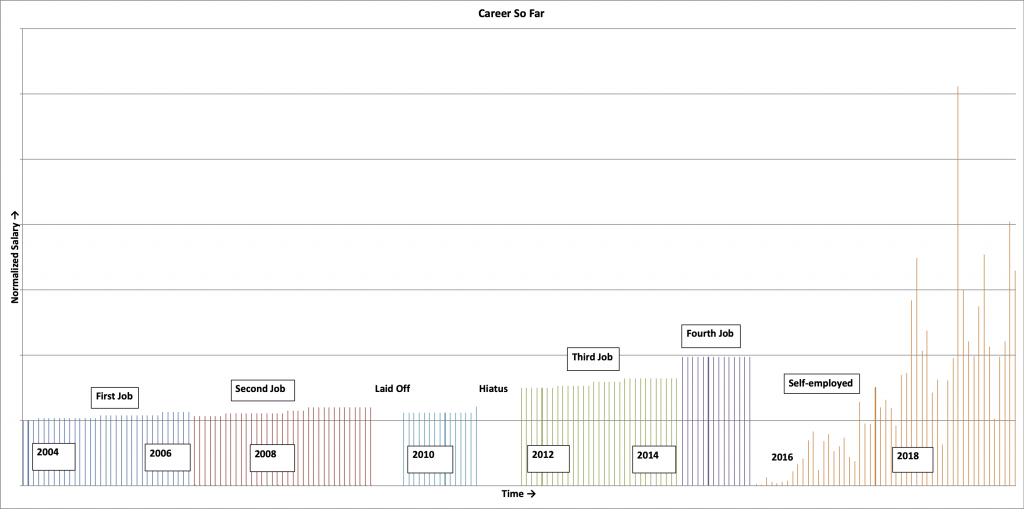

The nice thing about both of these is that they are testable. If I was right, then I should be able to build a business to capture the value of my work without working excessive hours. So I decided it was time to put up or shut up and I quit my day job in 2015. I haven’t updated this chart since 2015, so I went in and added in my business income since then and here’s what it looks like:

You can see that the first couple of years were very lean. But things started to take off in 2018, and they accelerated this year. I’m now generating far more value for my customers (millions of dollars over the past few years) than I ever did in my day jobs, I’m generating that value in fewer hours per week than I did at my day jobs, and I’m capturing more and more of that value for myself.

Two milestones to close out the year

The image above directly shows one milestone while indirectly showing another.

Income from my business now exceeds my day job income

It was slow going at first, and month-to-month income continues to be pretty volatile, but my overall income is significantly higher than it was at my day job.

Now I can definitively say that I can generate more value working for myself than I did at my day job and I can do it in less than 20 hours a week.

I’ve recovered all the savings I burned building the business

When I quit my day job in 2015, I had saved up a runway of about 18 months. The initial plan was to use that savings to bridge the gap while I built a business that supported me. Phase one was to publish Fearless Salary Negotiation. Phase two was to use income from Fearless Salary Negotiation to cover my expenses while I built TaskBook (a B2B SaaS app).

I quickly realized my plan wasn’t going to work. It was harder to generate meaningful product income than I thought, and building the Fearless Salary Negotiation business was going to be a full-time job. It wasn’t realistic to build two things that would require full-time effort, so I shut TaskBook down to focus on Fearless Salary Negotiation.

That was a good decision. But I was still burning through my savings pretty quickly and the business was growing slower than expected. Early in 2017 (about 18 months after quitting my day job), my runway had dwindled from 18 months to about three months and things were getting pretty dire. I began looking at day jobs and thinking hard about how to build my business into something that could sustain me and eventually make leaving my day job worth it.

That’s when I flipped the switch to focus on coaching as my primary business and things started moving up and to the right from there. My savings account pulled out of its nosedive beginning in May 2017. And in December of this year, it finally recovered to the high water mark that was set before I quit my day job.

The success of my business has come in several stages: When revenue actually started to turn up in early 2017, then when coaching started to really take off in volume and revenue, and now when I’ve totally replaced my day job with the business I created from scratch, built on a super-niche expertise that I developed over time.

I did not think this was possible even 18 months ago, but here we are.

The question now is how much value can I create and how much time will it take to generate that value?

Last year, I set a goal of doubling revenue in 2019. I missed that goal, but the point of the goal wasn’t so much to hit it as it was to force me to think about what my business would look like if I did hit that goal. It was a thought experiment codified as a goal.

At the time, I was thinking about doubling revenue in each part of the business, products and services (coaching). While it was unclear exactly how I would do that, I understood that doubling product revenue would probably be harder than doubling services revenue. I still don’t have a good answer for how to double product revenue, but I had some ideas on how to grow my coaching offering.

Products

Very quickly, I’ll talk about products. My revenue was up maybe 10% this year, and that’s fine. I didn’t create any new products and only made incremental changes with my sales funnels, so I couldn’t expect much change here.

I’m working on optimizing sales funnels, offering the right products at the right time, and generally trying to earn more revenue from the 100,000 or so visitors that come to FearlessSalaryNegotiation.com each month, but it’s slow going.

Salary negotiation coaching

January 2019 was my best month ever and that is still true. Almost 80% my revenue that month was coaching revenue. But I could sense a plateau lurking and I felt I needed to make a plan to push past that plateau before I got there.

The challenge was that I had worked very, very hard in January making it difficult to see how I could adjust one of the two most obvious levers to repeat or exceed January’s success.

The most obvious adjustments were to either work with more clients or raise my rates, but neither of those was really feasible. I didn’t think I could work with more clients and provide the level of service they deserved. That left raising rates, but that wasn’t really an option either because of some psychological hurdles I had begun to encounter.

My old fee structure

My fee structure at the time was both simple and complicated. Simple because I only charged a fixed fee up front to work with me. Complicated because that fixed fee was determined by “Total Offer Value” (TOV), a number I made up.

TOV was the total of base salary, sign-on bonus, and equity included in the offer. So an offer of $150,000 base salary, a $50,000 sign-on bonus, and $100,000 equity vesting over four years had a TOV of $300,000.

Here’s what the fee structure looked like:

Fee | Total Offer Value

$3k | < $300k

$6k | $300k–$600k

$9k | > $600k

I was able to work with clients in each tier, so it was “working”. But there were occasional objections about the structure like “Why should I pay you more for coaching when I did the work to get the good offer to begin with?”

I had good reasons for doing this, so I was pretty comfortable responding to those objections. Basically, higher-value offers required more work because they would often be paired with multiple offers from other companies and each offer would require more rounds of negotiation with more sophisticated recruiters and comp teams. Higher-value offers would also generate a higher nominal ROI on average, which meant my expertise was more valuable for higher-TOV offers.

There was also occasionally some discomfort around the step-function pricing. If someone had an offer with a TOV of $299k, they would pay $3,000 to work with me. But if their offer had a TOV of $301k, they would pay $6,000 to work with me. This didn’t happen often, but it was awkward when it did happen and I would sometimes make one-off adjustments to alleviate that awkwardness.

Still, it was working! The bigger issue was that I could see that plateau coming. There were two main things that concerned me:

- As I approached an up-front fixed fee of $10,000, there was real psychological resistance to paying that much for coaching.

- That resistance meant I would struggle to raise my prices beyond the existing fee structure and it meant it was harder to actually find clients in that top tier (which is obviously where I wanted to be).

My business is a weird hybrid of B2C (Business to Consumer) and B2B (Business to Business). My customers are consumers, but they think like businesses.

A major factor in their decision to work with me is “What’s the ROI on this? If I pay Josh for coaching, how much am I going to get back in terms of improved compensation?” That’s how businesses often approach spending decisions.

But when it came to the actual amount of money I charged, they thought more like consumers. “Six thousand dollars is a lot of money. That’s multiple mortgage payments.”

I don’t think this was a real issue before I started approaching the five-figure price point. But even the most business-minded clients would eventually become consumers and say, “I can’t send $10,000 to someone for a service.”

So I couldn’t just “charge more” to generate more revenue and find clients who put a higher value on my work because there was a psychological barrier around that $10,000 price point.

I also had a little bit of a psychological barrier myself: I had coached multiple clients who improved their TOV by more than $1 million, and I had only charged them a few thousand dollars to do it. On one hand, I was making a good living with the current fee structure. On the other hand, selling someone a million-dollar compensation improvement for $6,000 seemed a little … silly. It didn’t feel quite right to charge so little for a relatively enormous result.

My new fee structure

So I totally changed my coaching fee structure in April.

A quick reminder: January 2019 was my best month ever by a wide margin, and almost 80% of that revenue was coaching revenue. So the old fee structure worked really well.

But January 2019 was unusual because I started the month with a glut of clients waiting in the wings due to a weird hiring pause at some of the big tech companies. The last few months of 2018 had been pretty slow because I didn’t actually book new clients—they were all waiting on offers that showed up in January 2019.

Also, I had to work long hours to keep up with all that client work. So I knew if I had another month like that, I would have to work really hard again.

So what to do?

The answer: Switch to a fee structure where the up-front fee is less prohibitive and where I earn more when my clients earn more.

So I did. My new fee structure would be as follows: $3,000 + 10%.

$3,000 up front to work with me (a service fee), plus 10% of the improvement we negotiated in the first year’s total compensation (the result fee).

Still pretty simple, and I earn more when my clients earn more. Remember that client who got a million-dollar compensation improvement? That would’ve netted me a $25,000 result fee because that million-dollar improvement was basically $250,000 a year for four years. Ten percent of $250,000 in Year 1 would’ve been $25,000.

The two issues I felt would lead to a plateau would be significantly mitigated with this model.

Yes, that “I don’t know about writing a five-figure check to Josh” issue still persists, but they wouldn’t write that check unless we negotiated an additional $100,000 in the first year’s total compensation—a much easier check to write since that meant they’d keep $90,000 after writing that check.

Also, the up-front fee fell all the way to $3,000, which meant I would face a lot less resistance at the beginning of the engagement. And if I wanted to raise my rate, I could bump that fee up without tripping over any consumer psychology tied to that magical four-to-five-figure threshold.

Smart people have suggested that I charge a result fee for a couple years, and I resisted because I didn’t want to build my coaching business entirely on contingency pricing. Sometimes my clients don’t see an improvement in their salary—that’s just the nature of negotiating with big tech companies—but it’s not clear that will the be result until it is the result.

I just couldn’t stomach a business model where I might have a very busy month that also generated no revenue.

But since I had proven the pricing model with an up-front, fixed-fee price, I was able to transfer that to my new pricing so that I could charge enough for my expertise to cover my time and ensure I would be able to keep operating even if I had a few clients whose offers didn’t improve.

This makes sense to me because part of the value I bring is in monetary ROI, but for some clients the primary reason they hire me is they just want to be absolutely certain that when they start their new job at a big tech company, their compensation is the maximum possible compensation. I can always provide that reassurance using my proven methodology.

So how’s it going?

I haven’t done detailed numbers for 2019 yet, but there are a few data points that I think clearly indicate this is the right direction.

First, even with limited data, I’m pretty sure my average per-client revenue is higher than it was before even though my current service fee was previously the very bottom of my fixed-fee pricing range. That’s because the result fees I’ve earned have been meaningful.

Second, the clients whose total fees have approached that magical five-figure mark are thrilled to pay it because that means they will earn around $70,000 more in their first year at their new job. The service-plus-result fee structure makes sure that the reason they’re paying me that five-figure number is because they earned so much more.

Third, the revenue is spread out a little bit, which smooths month-to-month bumps and often sets me up for a good month before the month even starts. For example, the result fees I plan to collect in January 2020 (from engagements that finished in December) will make January my third best month ever even if I don’t see another dime of revenue all month. More likely, this January will be my best month ever, possibly by a wide margin, surpassing last January (which was an outlier driven by weird hiring practices at big tech companies late in 2018).

If you’re still reading, I’m impressed! And now we go full circle.

Last year, I set a goal of doubling revenue in 2019, mostly as a thought experiment on “What would my business look like if I doubled revenue?”

While I managed to more than double coaching revenue, product revenue only grew a little bit, so I didn’t hit that high-level goal of doubling revenue in 2019.

But with this new coaching fee structure, and even if product revenue is flat this year, I think I can double 2018’s revenue in 2020 because of this new coaching fee structure.

Mistakes were made (by design)

Before I wrap up, I should tell you about a pretty big misstep I had this year.

As soon as I changed my fee structure to the service-plus-result fee structure, I got pretty busy. Too busy. I had a ton of applications and I was struggling to keep up with demand.

The nice thing about the service-plus-result fee structure is that adjusting to demand (low or high) is easier since I can move the service fee up or down pretty easily.

I decided to run an experiment to see what the price elasticity for salary negotiation coaching looked like: I raised the service fee from $3,000 to $4,000.

I expected demand to fall (price goes up, quantity demanded goes down), but I didn’t know how much. I figured that even if it dropped significantly, I’d be comfortable enough with that $4,000 service fee that it wouldn’t matter.

I was right—demand fell—but I had no idea how much it would fall. As soon as I raised my service fee to $4,000, I entered a 10-week coaching drought where I booked zero new clients. Zero.

This was during a busy season when I still got a lot of applications to work with me (and the application clearly stated the higher price), but none of my prospective clients were actually hiring me.

Oops.

I did the math later and I suspect I probably lost about $20,000 in revenue with this experiment. I never booked a client at the $4,000 service fee price point and I dropped back to $3,000 in the middle of the year.

I’m ok with this result and I understood it was a possibility before I ran the experiment.

To uncover hockey sticks, I have to be willing to take real risks and run real experiments. In the long run, this experiment will make me much more than the $20,000 I spent running it.

How do I know that? Because I realized that I had bumped into another consumer pricing barrier. People who would hire me at $4,000 had different expectations and required a different approach than those who would hire me at $3,000.

I had gotten lazy with my “pitch” and fell into just describing the features of my coaching service. I would tell people “First we’ll do this. Then we’ll do that. Then I’ll get this information from you. Then the recruiter will ask for this, and we’ll tell them that.” It was very tactical.

That wasn’t ever a good pitch, but it was sufficient up to a $3,000 service fee price point. At that price, the people considering my service didn’t need much persuading, so what I said to help them decide whether to hire me didn’t matter very much.

But at a $4,000 price point, the pitch mattered more and my features-focused pitch wasn’t cutting it. I realized that I needed to focus my pitch on the benefits of working with me, not on the features of my service. People don’t care specifically what we’ll do step-by-step; they care about the outcome we’ll achieve together and how they’ll feel about the negotiation process when they work with me.

I will raise my price again in the future, and I think I’ll be able to continue finding new clients. I’ll start with a smaller jump in price (I think a 33% jump was too much), and I’ll be able to describe the service in a way that’s more compelling to people who might work with me. That’s a win. An expensive win, but a win nonetheless.

This is what running a business looks like

I know most of the people who read this have day jobs and might be wondering what it’s like running a business versus having a day job.

This is what it’s like. I run experiments all the time, and I look for experiments that I’m pretty sure will fail, only to see how much they fail so I can learn from them and apply what I learn back to the business to make it stronger.

It’s the anti-fragile approach to entrepreneurship. It’s uncomfortable and I love it.

Stats

Nothing too interesting to report this year other than more steady growth in revenue.

Visits to FearlessSalaryNegotiatin.com: About 1.1M

Unique page views: About 1.7M

Total email subscribers at the end of the year: ~46,000 (up from about ~26,000 to begin the year after a small end-of-year pruning in 2018)

Product sales through the site: ~800

Coaching clients: ~30

Product revenue: Up 10%

Service (coaching) revenue: Up 140%

Total revenue: Up 54%

Conversion rates are more or less the same as last year.

2019 Year in Review – Personal

Before I really dive in here, let me say that everything is great. Even though most of my highlights were difficult, the year itself was fantastic and I had a great time. It’s just that the things that stand out were pretty tough.

Injuries

I had a couple of injuries that set me back this year, so I got really familiar with rehab protocols.

Adductor

For most of 2018, my right adductor was sore and slowly got more sore as the year wore on. At first, I only noticed it during a specific dynamic stretch when I did my weekly track workouts. Then I noticed it was tight at the beginning of most of my runs.

Then I ran a half marathon and my adductor did not like that. I think I actually tweaked it during the penultimate week before the half when I went pretty hard on some shorter runs. The half marathon just pushed it over the edge to the point that it hurt pretty much all the time and it didn’t seem to be getting any better.

At first, I tried just resting for a couple weeks and that didn’t work, so I saw a doctor and a PT who both confirmed it was an adductor strain that would require some rehab.

I decided to take this pretty seriously because adductor injuries are sort of notorious for taking a while to recover and for recurring if you don’t recover fully before pushing it again. A friend of mine has had recurring adductor injuries that lasted years, and even now LeBron James is dealing with an adductor injury that doesn’t seem to be healing. I’m obviously not LeBron, but he has the best trainers in the world and he still can’t fix his adductor, so I knew it was going to be a slog.

It turns out adductor rehab is pretty relentless. For 8–12 weeks, I would spend about an hour a day doing various exercises to strengthen my core and eventually repair the adductor. And of course I couldn’t run at all while this was going on. It was pretty awful, but I just took it one day at a time.

It eventually started to get better, then I did a return-to-running protocol, and eventually I was able to run normally again. Only now, at the end of 2019, do I think I’m back to 100%.

Looking back and talking this over with my PT friends, I’m pretty sure this was an overuse injury exacerbated by a training error (I was running on graded roads, especially leading up to the half marathon, and I think that eventually hurt my adductor).

Shoulders

If that wasn’t enough, I also screwed up my shoulders. This injury was actually at its worst in the middle of 2018, but I tried resting and other half measures that didn’t do much.

The initial diagnosis was that I had biceps tendonopathy in both shoulders, so we started by rehabbing that issue. Early in 2019, that was starting to abate and we were able to see (via palpating, which is a fancy word for poking to see what hurts, and MRI) that the real culprit was likely infraspinatus tendonopathy from overuse, maybe exacerbated by minor impingement.

And so we started another round of rehab that overlapped with my adductor rehab. In addition to the seven days a week of adductor rehab, I added three days a week of shoulder rehab.

I cannot emphasize enough how mind-numbingly boring this was. And what made it even worse was that I was doing the rehab instead of normal running and weight lifting. So I was slowly getting further and further out of shape while spending a lot more time at the gym than I normally did.

Eventually, the rehab worked and I was able to start regular weight lifting again. My shoulder is basically 100%, but it occasionally reminds me that I overdid it last year.

As I finish out 2019, I’m back to normal running and weight lifting activity and I feel great. I’m also focusing on nutrition to make sure I get the most out of my workouts, and I’m paying closer attention to potential overuse injuries so I can catch them before they sideline me next time.

Eye surgery

This is not something I’m comfortable talking about, but it’s a big part of my year and kind of a big deal for me, so I’m going to power through it even if the writing will probably be stilted.

I’ll eventually write a longer post on this, but it’s worth capturing a snapshot for posterity here as well.

This year, I had eye surgery. Not that kind of eye surgery—you’re probably thinking LASIK or PRK—but surgery on my eye muscles. The technical term—mostly for Google—is bilateral strabismus surgery, which means an ophthalmologist moved the attachment points of the medial rectus muscles of both eyes so that they aligned better.

For the first time since I was a kid, my eyes work together. If you know me, you probably noticed this right away when you met me: I had a lazy eye. (Technically, I had “wall eye” since I had full vision in both eyes; lazy eye implies loss of vision in the affected eye). Since I’m left-eye dominant, that meant my right eye would drift.

This is not a great way to make a first impression on people. Fortunately, most people were kind about it and pretended not to notice. Meanwhile, any time I had face-to-face interactions (and I’m including “looking at a camera” with that), anywhere from maybe half to 80% of my mental energy went into trying to mitigate the lazy eye and keep it aligned with my dominant eye.

If there was anything worse than someone noticing my lazy eye, it was having a close-up action shot of the lazy eye show up on someone’s Facebook or Instagram feed. Most of the time, I could control my lazy eye long enough to snap a photo. Video was a totally different beast and I avoided it as much as possible. This BBC interview was cool because it was on international TV, but it was also a mental marathon. For three minutes, all I thought was, “Keep your eye focused on the camera. Keep your eye focused on the camera. Keep your eye focused on the camera.” The answers I gave were all more or less reused from my previous interviews or articles I had written, and it had to be that way because if I lost concentration for even a second, the eye would’ve drifted.

The best analogy I can think of is to imagine that any time you talk to someone face-to-face, you also have to balance a kickball on your head. If the kickball falls, the other person looks at you a little weird and quietly wonders what’s wrong with you. Most of your brain power would be focused on the kickball, and the leftover brain power would be used for that conversation.

That describes pretty much every social interaction I have had for my entire life. I could sort of control it, but it took almost all of my mental energy and lots of little coping mechanisms I developed over time.

Now I’m unlearning all of those coping mechanisms since I don’t need them anymore. I’m less worried about making a bad first impression and I’m slowly becoming more comfortable with cameras.

And while I feel quite a bit different, other people perceive me much differently. It was remarkable how many people had never said anything about my lazy eye, then suddenly I would talk to them and they would say, “Wow! It’s like talking to a different person.”

It’s too bad I can’t redo all those bad first impressions, but at least I won’t make any more.

Travel

I only took a couple trips this year, but they were a ton of fun.

In Breck for the Breckpocalypse

I had another amazing ski trip in Breckenridge and skied my first black (without falling!) to finish up the trip. Although I had an amazing time, I limited my skiing because my adductor was still in pretty bad shape.

In hindsight, skiing at all was probably a bad idea since I was only about four weeks into 12 weeks of rehab when I went on this trip. I was fortunate not to reinjure myself and I’m glad I took it easy.

It was still really fun to get back to Breck, and I’m glad I finally conquered a very easy black. I’m hoping to make some big leaps forward on the next trip in February.

My first trip to New York with a quick stop in Jersey

In June, a friend of mine was coaching in a professional flag football tournament so another friend and I went to New York to see the sights and root for some flag football.

We only got about two days in NYC, but we covered a lot of ground in that time. Not only did we see most of the popular sights, but we ate a lot of great food (and that’s really what I’m after when I travel).

It’s hard to pick standout moments, but Central Park is fantastic, and the 9/11 Memorial was really moving.

Running

Thanks to my adductor injury, I don’t really have anything to report this year. I’ve been mostly doing medium-distance runs of three to five miles a few times a week, and my pacing has been pretty strong. I tried a couple of track workouts later in the year and they went well, so I’m looking forward to doing more track workouts in the new year.

Best possible outcome

I won’t go into detail because this stuff doesn’t have to do with me directly. But this year could’ve been very, very bad in terms of pain and loss for my family. Several family members had significant surgeries and health scares, and all of them emerged on the other side happier and healthier than they were before.

In the early 2010s, I went through a similar stretch where pretty much everything went as badly as it could have. I lost a close friend and several family members during that time, and it was really painful. I’m so thankful that 2019 was the opposite and that my family didn’t have to experience that sort of pain and loss again.

2020 Goals

I’ve been putting this write-up off for the past month or so because I don’t really have new big-time goals for this year. I’m basically still going after the same goals from last year.

Increase revenue by 50% again

Last year, I set a stretch goal of doubling my revenue, and I “only” got to 50%. If I do another 50% this year, I’ll have more than doubled revenue over a two-year span. That would be pretty fantastic.

If I can increase both product revenue and coaching revenue by 50% each, I think that would be a great, balanced way to hit this goal. I suspect the improvement will be more skewed toward coaching, but I am focused on growing product revenue this year, so I’ll just have to see if I can get traction there or not.

Sub-7:00 pace 5k

Since I basically lost this year to my adductor injury, I’m refocusing on this goal and I hope to hit it this year.

Sub-60-second 400m

And while I’m training for faster speeds at shorter distances, I might as well take another crack at this goal. I’m still not sure it’s even possible for me, but I got so close in 2018 that I feel like I need to give it another honest effort.

One of my track workouts before the holidays was a 400m repeat workout and I got all my reps in the mid-80s range. That is better than I thought I’d be after a year off, so there is some hope that I can get this done. We’ll see.

Travel more

I’m carrying this one over from last year. I did ok with 2019, but I’d like to get some more trips in, especially since I have a ton of reward points on a couple of credit cards and it’s a shame for them to go to waste.

Be more generous

Business is good and my personal life is simple. There’s room for me to be more generous in many ways, and I want to be more intentionally generous this year. There are lots of ways to do this, and I don’t have any one way in mind. But “be more generous” seems like a good high-level goal to think about as each day passes.