Karl Smith of Modeled Behavior wrote a quick post about why he isn’t afraid of the big bad AT&T and T-Mobile merger. He quotes Annie Lowery on the merger, saying that AT&T-Mobile will have a 42% market share in the US. A few of my own thoughts on this:

- Market share is not a very good metric for identifying anti-competitive behavior (which is what matters when looking for anti-trust violations). Karl mentions in the post’s title that it’s not a “per se” offense, and he’s right. Simply having a large market share is not a per se Sherman violation (I am inferring that’s what he’s talking about – I could be wrong). It seems a little intimidating to have one big company with 42% market share, but that’s just one data point that doesn’t tell us much in a vacuum.

- I think this may just be a normal part of the industry lifecycle as it pertains to the number of firms in an industry. As industries mature, the number of firms typically collapses as the product becomes commoditized. With about 300 million wireless customers in the US, it seems safe to say that wireless is becoming a commodity and it is logical that the number of firms competing would be shrinking. There’s simply not room for too many firms to compete and maintain profitability.

The one thing that makes me a tiny bit skiddish here is that wireless bandwidth is still somewhat scarce thanks to the wireless spectrum limitations. As long as the wireless bandwidth is even a little scarce, there’s “extra” profit to be made, and having too few players in the industry could mean higher prices. But I don’t think we’re to the “too few players” point yet, and I think the higher price already exists since resource scarcity already exists. I’m not actually sure how scarce the bandwidth is, but Martin Cooper (among others) has been calling for more bandwidth to be dedicated for internet access, so wireless access could still use fatter wireless tubes.

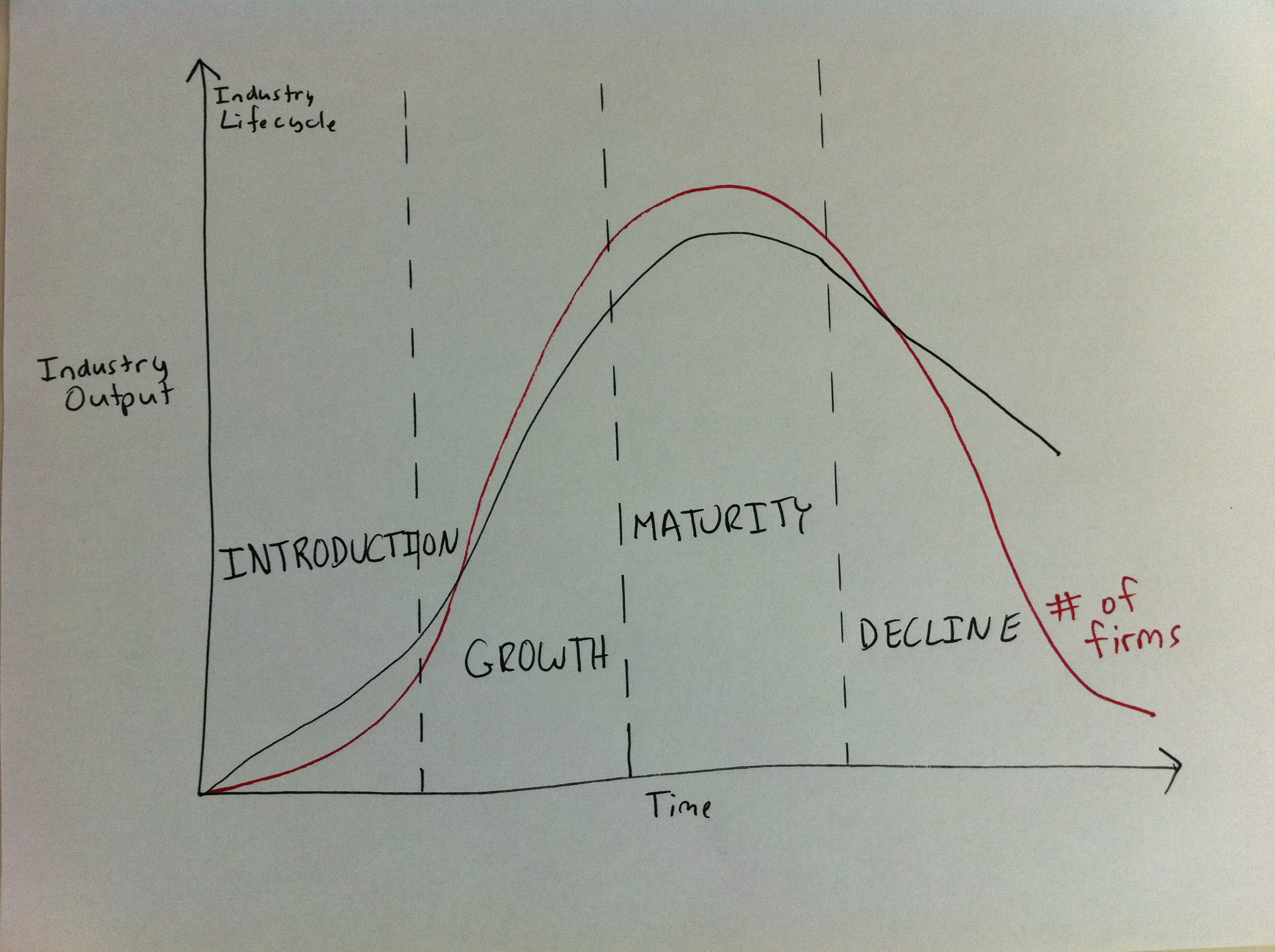

Anyway, here’s what the generic industry lifecycle looks like, and I’ve drawn the number of firms in the industry in red. Typically, the number of firms spikes and then eventually falls pretty quickly as firms consolidate in response to commoditization. How these curves look will vary by industry, but my guess is that the number of firms in wireless telecom in consolidating earlier than what I show in this graph (so the red line would scrunch to the left a bit, probably so the peak is in the mid-to-late portion of the “growth” phase). Seem like wireless telecom is into “maturity” phase* although there’s still some innovating going on (LTE, 4G, etc.).

*That’s not to say that handsets and other complementary technologies aren’t still growing. But wireless telecom seems to more or less be settled into moving data around the airwaves and is simply trying to find faster ways to do it.